Singapore income tax for foreigners is crucial information for every foreigners working in singapore, working in a foreign country can be overwhelming, especially when trying to comprehend the local labor laws and regulations. As a foreign worker in Singapore, understanding income tax system is essential for financial planning and compliance. This article offers a clear explanation of Singapore income tax for foreign workers, and we hope you can be understand.

Overview:

Understanding tax residency in Singapore

Determining your tax residency status is the first step in understanding your income tax obligations in Singapore. The inland Revenue Authority of Singapore (IRAS) has Spesification criteria for Tax residen in Singapore.

On the other hand, if you stay in Singapore for less than 183 days, you will be categorized as a non resident. Non residents are taxed differently, often facing higher tax rates on their income. This classification can significantly impact your overall tax liability, so it is essential to keep accurate records of your arrival and departure dates. Additionally, the residency status can affect eligibility for certain tax reliefs and deductions, reinforcing the importance of understanding where you stand.

It’s also important to note that tax residency can be affected by various factors, including employment contracts, temporary assignments, and family ties. If you are considering a long-term move to Singapore, understanding how your residency status may change over time can help you make informed decisions about your finances. Consulting with a tax professional can provide clarity and ensure that you are aware of all implications associated with your residency status.

Who Qualifies as a foreigners in Singapore

Foreigners working in Singapore include expatriates, foreign professionals, and other non-citizen employees. Your employment type and visa status determine how the tax rules apply.

Definition of foreigners workers and expatriates

Foreigners are generally defined as non citizens who residen in Singapore temporatily of permanen for employment purpose. This includes individual on work pass or Employmet Pass, S Pass

Categories of Foreigners Employees:

- Expatriates on Work Passes: Employment Pass, S pass holders, ETC

- Consulatnts and Freelancers: Individual providing services on a short-term basis

- Directors and Business owner: Non citizen managing companies

Tax rate Singapore

Income tax rates deoend on a personal tax residency status. You will be treated as ataxpayer for the year of assessment (YA) if you are:

- Singapore citizens or Permanent Residents who reside in Singapore and are not just staying temporarily

- foreign nationals living or working in Singapore

- At least 183 days in the previous calendar year; or

- Foreigners who have worked in Singapore continuously for 2 calendar years and a total stay of at least 183 days. This applies to employees entering Singapore but does not include company directors, public entertainers or professionals

If you do not meet the above requirements you are not part of the Singapore population for tax purposes.

Singapore’s personal income tax rates for tax residents are progressive. This means that higher income earners pay proportionately higher taxes, with the highest personal income tax rate currently at 24%.

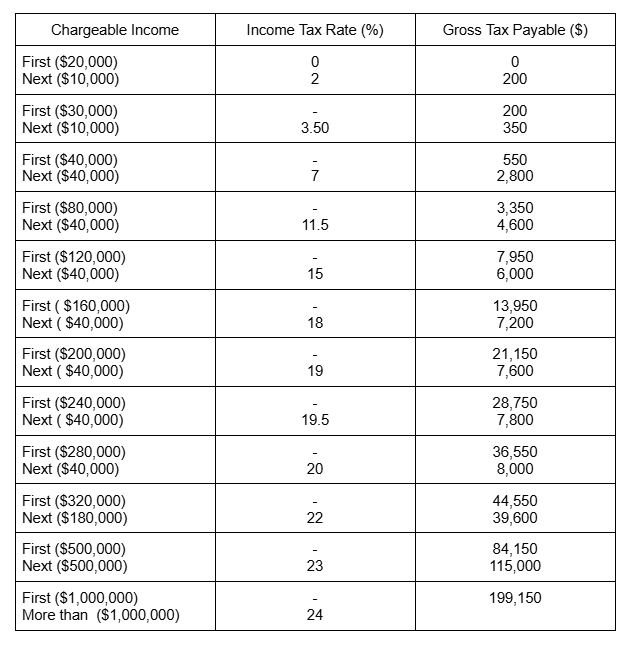

In order to achieve progressive results, personal income tax rates will increase starting in 2024. Income taxed above $500,000 up to $1 million will be taxed at 23%, while income above $1 million will be taxed at 24%; both increases from the current rate of 22%.

Resident Tax Rates From YA 2024 onwards in Singapore

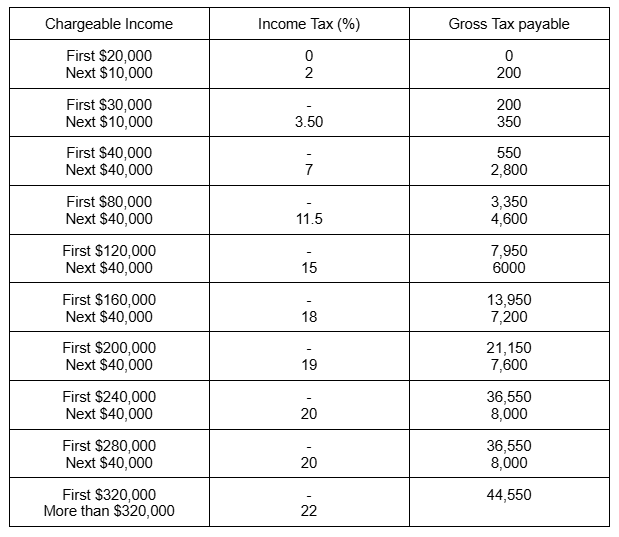

Resident Tax Rates From YA 2017-2023 onwards in Singapore

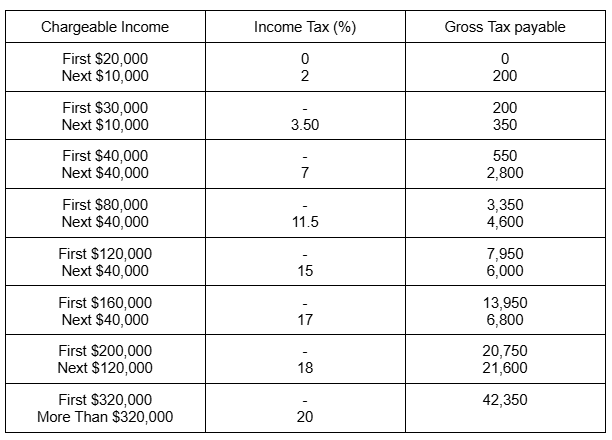

Resident Tax Rates From YA 2014-2016 onwards in Singapore

Key Point:

- Higher income means higher tax rates

- Income is devided into different brackets, each with its own tax rate

- The tax on each bracket is added to the tax on the previous brackets.

Hiring a tax professional in Singapore

Navigating the intricacies of Singapore income tax can be challenging, especially for expatrictes unfamiliar with local regulation. Hiring a tax professional can be a wise investment. Tax professionals in Singapore possess in dept knowledge of the local tax laws including the nuances that may affect expatriates, such as residency status, available reliefs, and filing requirements. Their expertise can help you navigate the complexities of the tax system with confidence.

A tax professional can also assist you in optimazing your tax position by identifying eligble deductions and reliefs that you may have overlooked. They can offer presonalized advice based on your unique financial circumstances, ensuring that you are not leaving money on the table. Furthermore, their guidance can be invaluable in preparing your tax return accurately, helping to avoid mistakes that could result in penalties or audits.

Moreover, a tax professional can provide ongoing support throughout the year. This is especially beneficial if your financial situation changes due to changes in employment, investments, or family circumstances. Having a reliable advisor who understands your long-term financial goals can help you make informed decisions that align with your overall financial strategy. Ultimately, hiring a tax professional can simplify the tax filing process and provide peace of mind, allowing you to focus on your career and personal life in Singapore.

Simple FAQ for Singapore income tax foreigners

What is the tax rate for non resident foreigners in Singapore?

Non resident tax rates on employment income is taxed at the flat rate of 15% and Taxes on director fee, consultation fees and all other income for non resident individual is currently at 24%. it applies to all income including rental income from properties, pension, and directors fees.

Do the foreigners workers need to pay CPF Contributions?

No, CPF contribution are not required unless the foreigners become a Singapore citizens or permanent residents (PR)

Is overseas income taxable for Foreigners?

No, overseas income is generally exempt unless it is remitted to Singapore under soecific circumstances.

How can foreigners reduce their tax burden in Singapore

They can untilize DTAs ( Avoidance of Double Taxation Agreements ), Claim available reliefs, and ensure they qualify for resident status.

References

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of-individual-income-tax/tax-residency-and-tax-rates/individual-income-tax-rates

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of-individual-income-tax/tax-residency-and-tax-rates/claiming-exemptions-under-Avoidance-of-Double-Taxation-Agreements-(DTAs)#:~:text=Individual%20Income%20Tax%20rates,Claiming%20foreign%20tax%20credit

Some of information you might be needs