What is a CPF Contribution? and What is the benefits? “some of foreigners becoming considering Singapore citizenship have this in mind.”

CPF is: Central provident fund. is a mandatory social security savings scheme funded by contribution from employers and employees, CPF is also a key pillar of Singapore social security system and serves to meet our retirement, housing and healthcare needs, CPF have 3 purpose in Singapore.

- CPF Mission: To enable Singaporeans to have secure retirement, though lifelong income, healthcare financing, and home financing

- CPF Vision: To be a trusted and respected social security organisation, committed to enabling Singaporeans to have a secure retirement.

- CPF Value: Integrity, Service, Excellence

Overview:

History of Central Provident fund (CPF)

CPF bord was estabilished on 1 july 1995 to help workers save for their retirement by contributing part of their monthly income. in 1968 the singapore goverment introduced a public housing scheme allowing Singaporeans to use their CPF savings instead of taking home pay to finance mortgages in their HDB flats.

By making housing more affordable, many Singaporeans were able to own homes. This has become a key pillar of retirement security, as Singaporeans in their senior years no longer have to pay rental fees out of their retirement savings.

it’s main purpose is to serve and meet housing, retirement and healthcare needs, it’s worth noting that the government also supplements the CPF savings of lower-wage workers.

How to contribute to CPF

Every pay period, every single month, employer are obligated to deduct a portion of employee salaries and will directly into their CPF account. Contribution for CPF is a base on your salary and age if you are selft-employed, you can make voluntary contributions to your CPF account. The contribution amount is based on your estimated income

If you are starting to make contributions for your employees but you dont have CPF account, the first steps is to apply for a CPF number (CSN), CSN is a unique identifier for your CPF contributions, If you dont have CSN you can Apply CSN in here.

For your information : Only individuals trading under their own name should use Singpass to access their CPF account.

You also can read this: What is ACRA Bizfile Singapore

Who is eligible for CPF

As an employer in Singapore, you are required to contribute to the CPF accounts of your employees who are Singapore citizens or permanent residents working under formal employment contracts. Employers must pay both the CPF employer contribution and employee share of CPF contribution every month. They are entitled to recover the employed under a permanent part time, or casual basic.

Employee foreigners have to pay CPF?

Generally, no, foreigners are not required to pay CPF contribution in Singapore, CPF is a mandatory savings scheme primarily intended for Singapore citizen and permanent residents. However, there are a few exceptions:

- Singapore Permanent Residents (PR): if a foreigners become a Singapore Permanent Resident, they are required to contribute to CPF.

- Foreign employees with special arrangemets: in some specific cases, such as for highly skilled foreign workers or those employed under certain government schemes, there might be arrangements for CPF contributions.

How much is CPF contribution

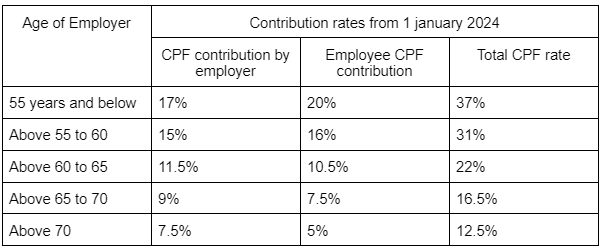

it depends on your age, as a employer CPF contribution rates you need to pay for your employee below 55 years old is 17%. Here is table of percentage CPF contribution:

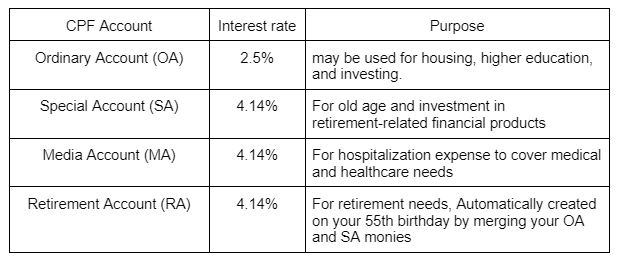

Type of CPF account and Interest rate

If you are a Singaporean or PR holder you have following CPF accounts.

How many CPF for contribution per person

If you are have emoloyed by more than one employer, all your employer must pay CPF contribution based on the wage payable to you. This is because OW (ordinary wage)ceiling is applicable on per employment basis.

If your total OW from your employers exceeds the current OW Ceiling, you may apply to limit your share of contributions. There will be no change to the employer’s share of CPF contributions. The Total CPF contribution rate is 37% (wage > $750) of your monthly wage, 17% is contributed by your employer, while 20% comes out of your salary.

For example:

Example 1

If your age of employee below 55 years old, your contribution as employer is 17% and your employee is 20%, the wages is $1000 :

Employer: 17% x $1000 = $170

Employee: 20% x $1000 = $200

Total CPF Contributions is = $370

Example 2

If your Employee above 55 to 60 years old, your contribution as employer is 15% and your employee is 16%, the wages is $6000:

Employer: 15% x $6000 = $900

Employee: 16% x $6000 = $960

Total CPF Contribution is = $1860

If you are still confused about how to calculate your CPF contribution, you can use the CPF Contribution Calculator tools to determine you total contributions.

What is the due date for CPF contributions?

Due date for CPF contributions is on the last day of the month, Employers who don’t pay CPF contributions by the 14th of the following month (or the next business day if it’s a weekend or public holiday) will face penalties. These penalties include a late payment interest charge of 1.5% per month starting from the day after the due date. Ensure that CPF contributions are paid on time and Communicare paymet dates to your employees.

Conclution

The Central Provident fund (CPF) is a compulsory savings system in Singapore that advantages both empolees and employers. It’s mutually beneficial and here is why contributing to CPF is beneficial:

For employees: Employees can enjoy retirement savings, home ownership, healthcare, education and investment opportunities through the CPF.

For employers: Employer can benefit from reduced payroll costs, tax advantages, employee retention, and social security through the CPF.

So, have you contributed your CPF?. Click here to call us for more information or to sign up for this service, we will be happy to assist you with a free consultation.

Reference:

- https://www.mom.gov.sg/employment-practices/central-provident-fund/what-is-cpf

- https://www.mom.gov.sg/employment-practices/central-provident-fund/employers-contributions

- https://www.cpf.gov.sg/member