OVERVIEW

Running a business can be risky and challenging. Whether you’re a startup or a serial entrepreneur, you can never be too careful managing the financial health of your business.

By learning the basic accounting terms, you can make better informed financial decisions and navigate in the right direction. In this article, we list top 10 accounting keywords to help you understand the basics.

1. ACCOUNTS PAYABLE (AP)

Accounts payable refers to the amount a company owes to vendors or suppliers for goods or services not yet paid for. Payables appear on a company’s balance sheet as a current liability. To improve cashflow, these outstanding bills are sometimes paid as closer to their due dates.

2. ACCOUNTS RECEIVABLE (AR)

Accounts receivable is essentially the opposite of payables. It refers to the amount the customer owes to the company for goods or services purchased on credit. This happens when your business does not receive payment immediately.

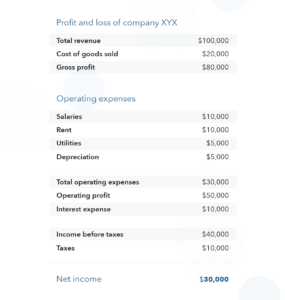

3. PROFIT AND LOSS (P&L)

A profit and loss statement is a financial statement presenting your business’s revenues, costs and expenses during a specific time period (ie. quarterly, monthly, or yearly). It is also known as P&L, income statement, operating statement, and statement of financial performance.

Profit is the difference between your income, cost of goods sold, and expenses; while Loss refers to an excess of expenses over revenues.

4. EXPENSES

Expenses are the costs associated with doing business, namely Cost of Goods Sold (COGS) and Operating Expenses (OPEX).

COGS refers to the direct cost of producing your goods and services; while OPEX are indirect costs of your business such as rent, equipment, payroll, marketing, inventory, R&D, etc.

5. BALANCE SHEET

A standard balance sheet records a company’s financial history using three categories:

– Assets, eg. property, vehicle.

– Liabilities, eg. debt, loan, credit.

– Owner’s equity or capital.

A balance sheet informs stakeholders of what a company owns and owes to third parties. It gives insight on a business’ liquidity.

WHERE TO GET ASSISTANCE

If you need Accounting & Bookkeeping assistance for your business, our experienced team at One Accounting Services Singapore can support your filing and reporting needs.

To make an enquiry, you may fill up our form below or contact us directly at (65) 8155 3359.